In 2012, Pennsylvania fully

implemented their local tax reporting requirement called 'Act 32' which

resulted in a large number of local municipalities being added to

Abra's tax tables. Two of them, PADS (Uwchlan Twp) and PADI (Kennett

Square) improperly appear on the "Unemployment/Disability Wages" report.

As best as we can tell, the report is based on the names

of the tax codes, not any flag or data value relating to them. Thus,

these two codes appear because they have 'DS' and 'DI' as part of their

names (which are both common abbreviations for 'Disability'). The

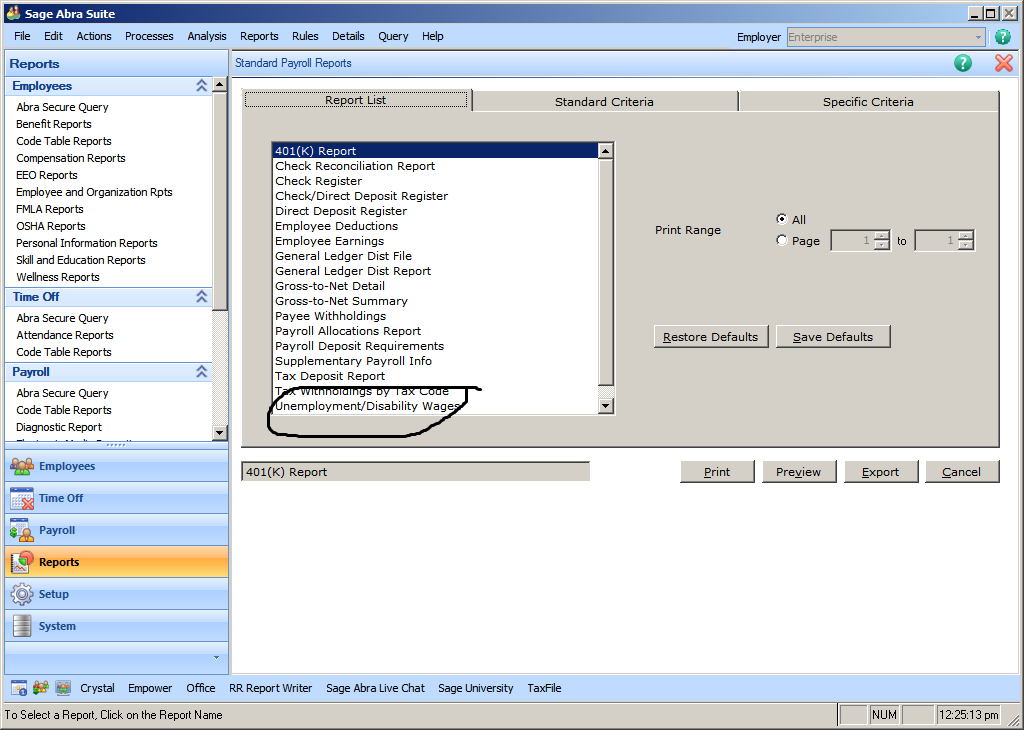

report is under the menu Report -> Payroll -> Standard Payroll

Reports:

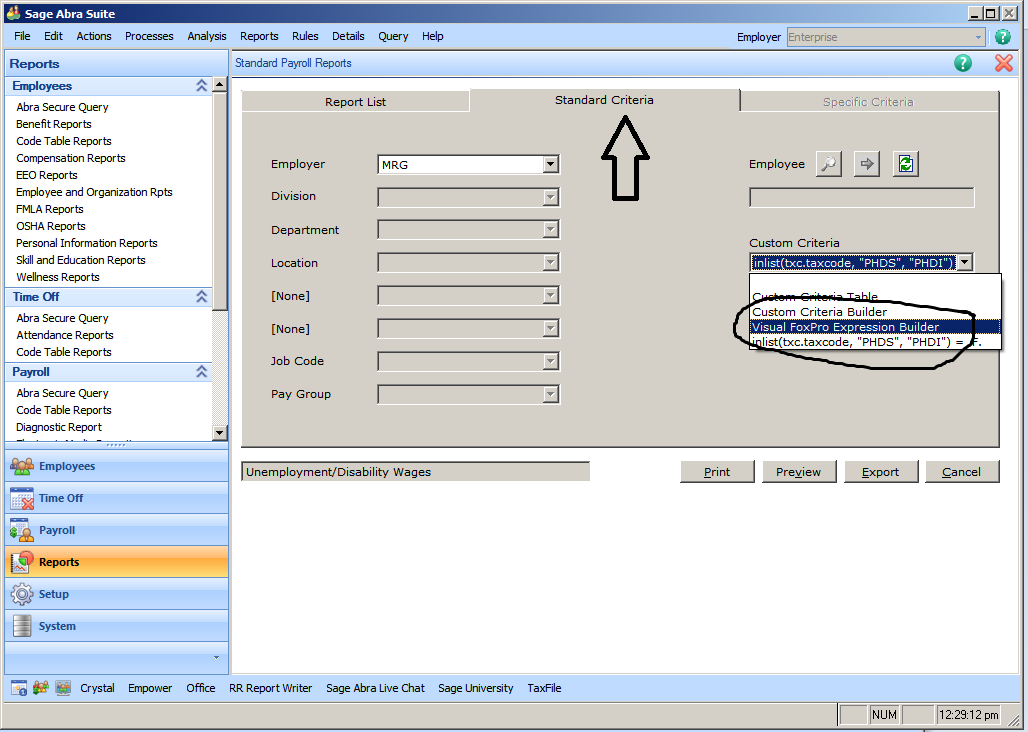

Select this report and then click on the 'Standard Criteria' tab .

Here is where you can define additional restrictions to control what

appears on the report. In this case, you want to prevent the two codes

from appearing on the report. Click on the dropdown under 'Custom

Criteria' and select 'Visual FoxPro Expression Builder.' The

'Expression Builder' will appear:

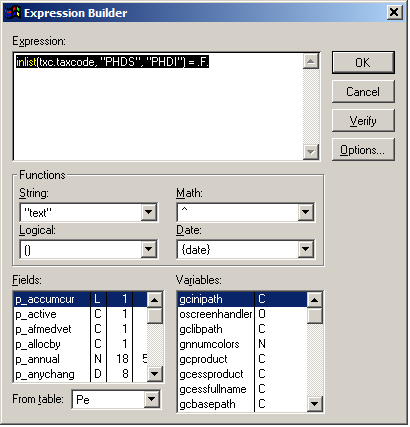

.

Here is where you can define additional restrictions to control what

appears on the report. In this case, you want to prevent the two codes

from appearing on the report. Click on the dropdown under 'Custom

Criteria' and select 'Visual FoxPro Expression Builder.' The

'Expression Builder' will appear:

Type in the expression shown: INLIST(txc.TAXCODE,

"PHDS", "PHDI") = .F. and click 'Verify' and 'OK.'

Now when you go to run the report, it will exclude these codes. For the

example I have chosen a specific company code, but you should use your

own as needed.